Why Mongolia?

ION Energy’s leadership team has strong in-country experience, having successfully operated in Mongolia for over a decade. The team has confidence in Mongolia as a successful mining and investment-friendly jurisdiction, and as one of the fastest-growing economies in the world. Specifically, Mongolia is attractive to resource entities and investors for the following reasons:

Mongolia’s mining industry is the nation’s leader employer, and contributes towards 20% of the GDP & 90% of its exports

-

- Neighbour to two giant markets: China & Russia

- Low transportation costs to Chinese battery markets

- No historical exploration in battery metals

Government prioritizes an investment-friendly environment

-

- Low corporate income tax and government royalty obligations

- Borders open and increased rail infrastructure

- Growing technology hub

- Government anti-investment regulations revoked in 2014

- Proactive and effective nationwide approach to COVID-19, creating opportunities for businesses with an in-country presence

Untapped and unlimited potential for lithium

-

- No historical exploration in and new, under-explored frontiers for battery minerals

- Geologically well-endowed and high-quality exploration land asset

Mongolia in the news

Mongolia’s Critical Mineral Strategy Eyes Key Supply Chain Role

The US and Mongolia Sign MOU to Collaborate on Critical Minerals

French President Macron Makes a Historic Visit to Mongolia

Germany Looks to Mongolia in Push for Critical Raw Materials

Mongolia Quickly Becoming the Place To Be for Those Chasing Mineral Riches

Mongolia: A Fast-growing Economy with Unique Mining Opportunities

New Trade Policies Unlock Foreign Investment in Mongolia

With New PM, a New Generation Taking Charge in Mongolia – The Diplomat

Greening the China-Mongolia-Russia economic corridor: A visual synthesis

Building Resilience: Q&A with Bank of Mongolia’s First Deputy Governor Erdembileg Ochirkhuu

Is Mongolia the next emerging market for your international business strategy? – Trade Ready

“The Mongolian economy is largely commodity-based and is considered by the World Bank to be stable and growing. The country’s GDP reached US$13.01 billion in 2018 with a growth rate of approximately six percent. Mongolia enjoys social and political stability and offers a low cost of doing business for international miners.”

Investing News Network

Why ION Energy’s Mongolian site is a Geographic Advantage

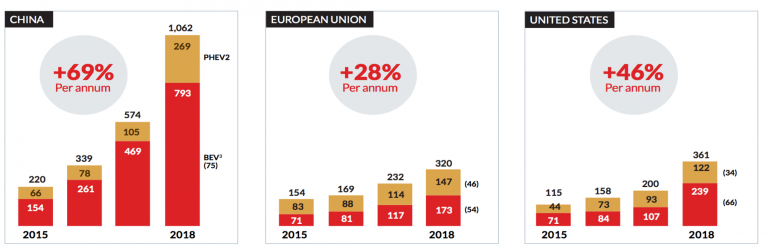

- China is the world leader in manufacturing lithium batteries, and continues to outpace the globe in demand for EVs

- Korea, Taiwan and Japan’s large tech industries will continue to fuel demand for lithium batteries.

- China dominates megafactories: 89 of 123 of the world’s megafactories in the pipeline are in China, with one megafactory being built per week” (Benchmark Mineral Intelligence – 2020)